Are you accurately tracking your political opponent’s media competitive?

February 17, 2015 by Bruce Mentzer

Excellent new tools, including the FCC reporting website, custom target ratings and CMAG/Kantar spot tracking data integration, have revolutionized political media competitive collection, analysis and reporting.

Is your campaign media buyer using all of the resources available to give you the most accurate analysis of what your political opponents and supporters are doing on TV, cable, radio and satellite?

One of the most important responsibilities that a political and issue media buyer has is the collection, analysis, and reporting of competitive media spending and schedule weight for all parties advertising in relation to your race or issue campaign.

The old method…

Buyers would collect opponents (or supporters) media spending, and then by “estimating” a market CPP for candidate, or issue, calculate the “estimated” rating points that may have been achieved by all for that period of time. Then simply report the estimates it in a simple spreadsheet.

The new method…

Buyers collect media spending on both sides, and then using a host of sources zero in more accurately on estimating a specific individual cost per rating point for each of the competing advertisers, giving a much more accurate picture of media weight in the market (i.e., how many spots and points does each really have?).

The biggest reason most “old school” competitive reporting is inaccurate is that each advertiser has their own distinct CPP, and the old way generally uses only one CPP for all candidates in a market, and one CPP for any and all issue advertisers in the same market.

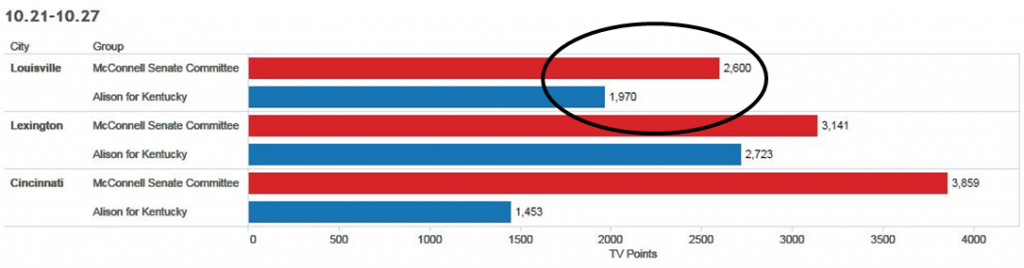

Example A: McConnell CPP used for estimating Grimes competitive showed her with fewer points for the 10.21 flight.

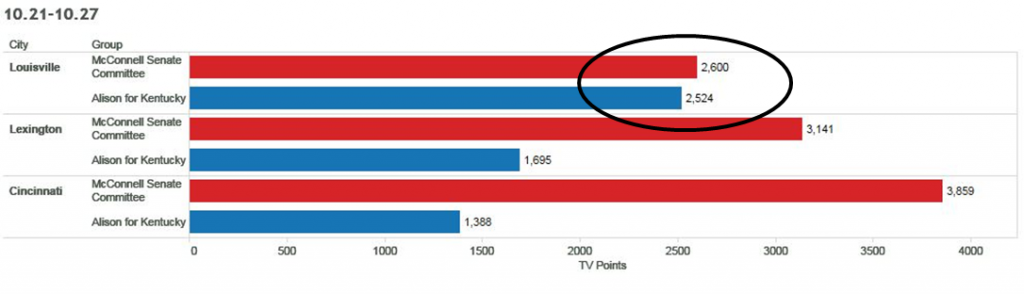

Based on the analysis of these new sources of information, we found that within the same race and market candidate CPP’s were drastically different from one another, and that issue CPP’s were even more varied within the same market and race. Using only one CPP for all candidates and one CPP for all issue does not give you an accurate picture of true weight for each advertiser in the market.

Example B: Exact Grimes CPP ascertained through tracking data and custom ratings applied to her buys showed her much closer to our schedule weight in Louisville for the 10.21 week

Why would cost-per-rating points differ between advertisers in the same category, and during the same flight period? There are many reasons.

CPP’s can change based on not only daypart configuration of a media buy (more daytime, lower CPP, more prime time, higher CPP, etc.) but also depending upon when the buy was placed. A media buy placed months before airing will have a much lower CPP than a buy placed a few days prior to the start date. Also, a candidate’s campaign media buys qualify for lowest-unit-rate (LUR) and therefore will cost less than issue/advocacy/IE media buys — which have no set rate card and will usually have much higher costs.

Where to find better information by which to summarize and report more accurate competitive?

All candidate and issue TV buys are now on FCC website.

The stations now post to the FCC site all issue and political media schedules within about 24 hours of the buy being placed. So usually within one day of the schedule starting, you can see exactly what each TV buy consists of (programs purchased, number of spots, rates paid). The full buy can be pulled down from the site to be scrutinized for daypart configuration, and by entering the schedule against your own campaign target audience, the exact CPP can be ascertained for use in the competitive comparison and reporting. (The FCC is reviewing making cable, radio and satellite outlets also post buys to their site – which would greatly improve this tool for use in analyzing competitive for other mediums.)

The coupling of custom targeting data (Big Data) and the CMAG/Kantar TV spot tracking data has made a much more detailed review and analysis possible.

Within a day or two of spots airing, these new data dashboards show you exactly how many “custom” rating points your opponents (and supporters) received for their actual buys (against your target audience). By factoring this against the estimated daily media spending that you already collected for each, you have an almost exact CPP for reporting the coming days and weeks competitive. (Our new reporting summaries can also show smaller periods of competitive, just the coming weekend, or last three days, etc. giving you a much better report on day to day activity.)

With most campaigns these days wanting to “match” their opponent’s media buy weight to make sure they are not being “out voiced”, precise accurate competitive reporting is a must for crucial media spending decisions.

And even if your campaign can’t afford the custom ratings data, or CMAG spot tracking integration dashboards, the new horizon allows for full review of each advertisers TV buy on the FCC site. Your buyer should be taking the extra time to use all tools available to be reporting to you the most accurate competitive possible – and saving you money in the process.

Want to know more about collecting, analyzing and reporting competitive? Contact Mentzer Media at (410) 825-7034.

Recent Posts

- It’s time for disclaimers on electioneering digital ads.

- Political media buy reconciliations are going on now. Is yours being done properly? And without any additional charge to you?

- According to Nielsen, TV still dominates media consumption.

Archives

- November 2017

- January 2017

- November 2015

- September 2015

- February 2015

- October 2014

- September 2014

- August 2014

Categories

- Cable

- Candidate Advertising

- competitive

- competitive analysis

- Digital

- Disclaimers

- Issue Advertising

- Lowest-Unit-Rate

- LUR

- media buy competitive

- Media Buying

- media competitive reporting

- Media Targeting

- Political Media Buying

- Radio

- reconciliation

- Satellite TV

- Super PAC

- Targeted

- Uncategorized